VA Loan Benefits for Surviving Spouses

[fa icon="calendar'] Mar 27, 2019 9:15:00 AM / by Eustis Mortgage posted in credit score, real estate investing, housing options, getting mortgage approved, today's interest rates, Eustis Family of Companies, mortgage stress, mortgage savings, mortgage calculator, retirement, obstacles to homeownership, mortgage credit availability, mortgage credit, closing costs, overcoming real estate fears, property taxes, home builder confidence, home value, homebuying tricks, natural disasters, mortgage mistakes, mortgage underwriting, transitioning into homeownership, home appraisal, housing affordability, mortgage information, VA loans, Active Military and Veterans, Loan Officer

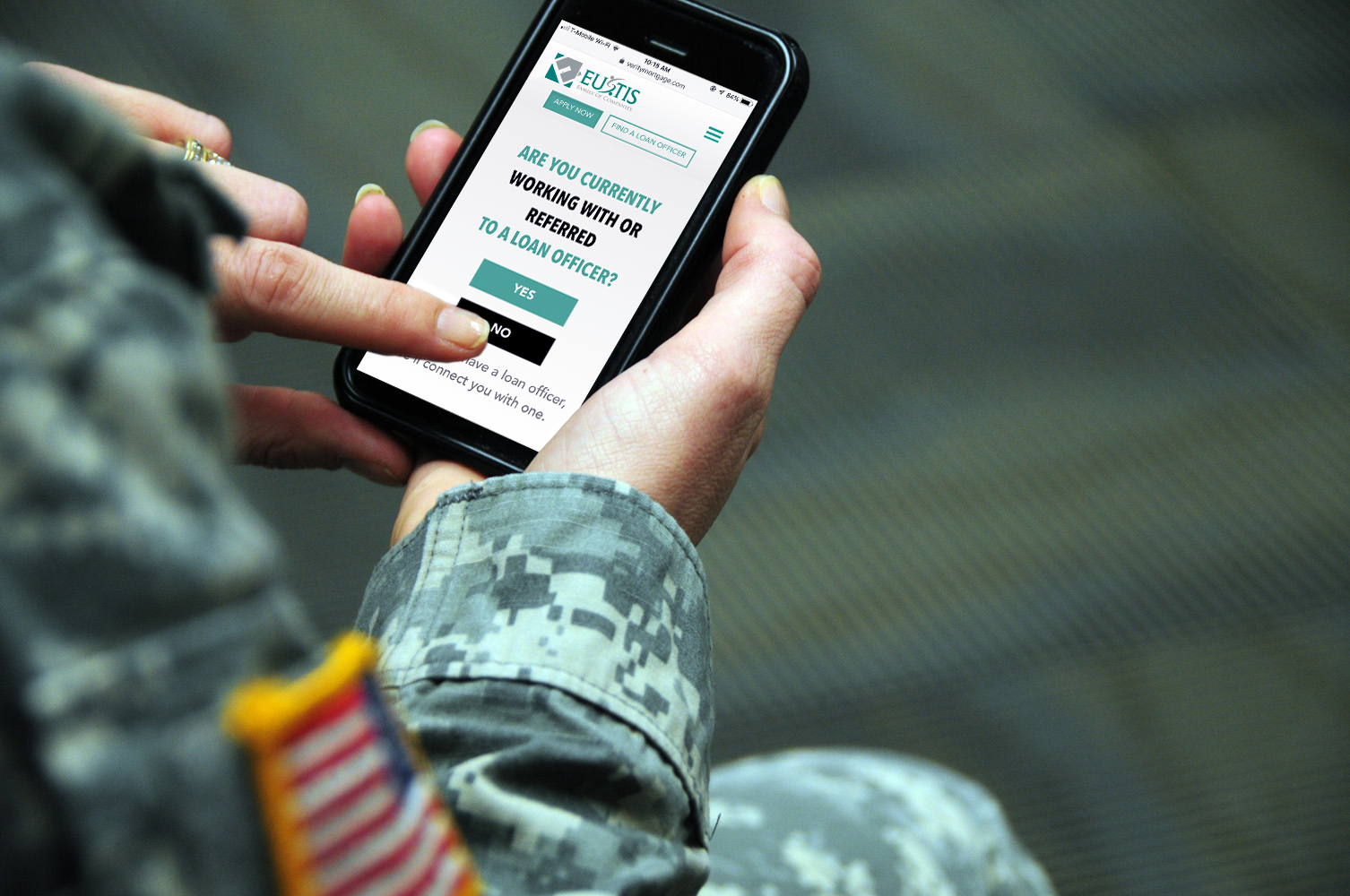

VA Loans More Popular Than Ever

[fa icon="calendar'] Mar 20, 2019 8:50:00 AM / by Eustis Mortgage posted in home prices, mortgage credibility, mortgage credit, millennial homebuyers, home renovations, federal reserve, home value, homebuying tricks, mortgage mistakes, mortgage market, fha 203k loans, mortgage after divorce, transitioning into homeownership, home appraisal, housing affordability, mortgage information, title insurance, VA loans, Active Military and Veterans

A Complete Guide to VA Loans

[fa icon="calendar'] Mar 5, 2019 10:33:00 AM / by Eustis Mortgage posted in millennial homebuyers, FICO Scores, property taxes, homebuying tricks, mortgage mistakes, home building, mortgage after divorce, transitioning into homeownership, housing affordability, mortgage information, VA loans, Active Military and Veterans

A Complete Guide to Renovation Loans

[fa icon="calendar'] Feb 13, 2019 11:30:00 AM / by Eustis Mortgage posted in stock market, retirement, MCAI, holiday season, single women homebuyers, mortgage credit availability, disaster recovery, 203(k) loan, millennial homebuyers, dodd-frank act, home financing, common real estate fears, overcoming real estate fears, inflation, home renovations, home builder confidence, freddie mac, real estate scam, home value, flood insurance, homebuying with student loan debt, pending home sale, homebuying tricks, natural disasters, awards, mortgage market, fha 203k loans, mortgage underwriting, mortgage after divorce, transitioning into homeownership, housing affordability, mortgage information, VA loans, Active Military and Veterans, Loan Officer

Fall in Love with Your Home Again with a Renovation Loan

Are you ready for something new but not ready to move? A renovation loan just may be what you're looking for. It allows you to make your current home into your home for the future and offers opportunity to refinance and renovate with the same loan! With no second lien requirement and the benefit of rolling in renovation costs, you'll keep the convenience of making one affordable monthly payment. It may also be possible to lower your interest rate, move to a shorter loan term and possibly lower payments.

A Financial Checklist for Homebuyers

[fa icon="calendar'] Dec 19, 2018 11:53:00 AM / by Eustis Mortgage posted in fannie mae, freddie mac, real estate scam, federal reserve, home value, flood insurance, student loan debt, homebuying with student loan debt, pending home sale, ind, homebuying tricks, natural disasters, mortgage mistakes, awards, mortgage market, home building, fha 203k loans, mortgage underwriting, rental property, mortgage after divorce, transitioning into homeownership, home appraisal, housing affordability, mortgage information, title insurance, VA loans, Active Military and Veterans

It's easy to get caught up in the excitement of buying a home. Whether you're buying your first home or your 10th, it's good to stay organized and remember everything that needs to be in order financially before purchasing. Here's a lucky list of 7 different finance costs to remember to keep in your budget while purchasing.

4 Ways to Use the Equity in Your Home

[fa icon="calendar'] Dec 13, 2018 10:24:19 AM / by Eustis Mortgage posted in Eustis Family of Companies, mortgage savings, lender lingo, stock market, Announcements, co-signing a mortgage, interest rates, MCAI, obstacles to homeownership, housing industry, homebuilder sentiment, mortgage credit availability, closing costs, dodd-frank act, overcoming real estate fears, property taxes, home renovations, home builder confidence, federal reserve, home value, pending home sale, ind, awards, mortgage market, rental property, housing affordability, title insurance, VA loans, Active Military and Veterans, prepaids

Military Home Savings

[fa icon="calendar'] Nov 12, 2018 11:58:50 AM / by Eustis Mortgage posted in retirement, MCAI, housing industry, mortgage credit availability, disaster recovery, 203(k) loan, FICO Scores, closing costs, common real estate fears, home renovations, home builder confidence, freddie mac, federal reserve, home value, student loan debt, homebuying with student loan debt, ind, homebuying tricks, mortgage mistakes, awards, home building, mortgage underwriting, mortgage after divorce, home appraisal, housing affordability, mortgage information, title insurance, VA loans, Active Military and Veterans

Advantages of Becoming a Homeowner

[fa icon="calendar'] Aug 13, 2018 9:30:00 AM / by Eustis Mortgage posted in homeowners insurance, mortgage stress, mortgage savings, credit card rule, mortgage credit availability, disaster recovery, mortgage credit, FICO Scores, closing costs, home financing, overcoming real estate fears, home builder confidence, fannie mae, federal reserve, student loan debt, ind, mortgage mistakes, awards, mortgage after divorce, home appraisal, housing affordability, mortgage information, VA loans

Renting seems like the easy way out to most people. Although rent prices fluctuate each year, you only pay rent and utilities with a landlord at your fingertips to fix any and every problem, and the flexibility to pack up and venture out to the next city without any attachment. Yes, these are some perks that make it easy when you are young and finding your path. What about when you finally get that job you want to keep and can picture yourself staying there for some time?

Home Features Buyers Will Pay Extra For

[fa icon="calendar'] Jul 29, 2018 8:27:00 PM / by Eustis Mortgage posted in disaster recovery, millennial homebuyers, FICO Scores, home financing, property taxes, home renovations, freddie mac, real estate scam, home value, flood insurance, homebuying with student loan debt, pending home sale, homebuying tricks, natural disasters, awards, mortgage market, fha 203k loans, mortgage underwriting, mortgage after divorce, transitioning into homeownership, housing affordability, mortgage information, VA loans

What are buyers willing to pay more for and what is the likelihood they will pay for it?

New Home Check List

[fa icon="calendar'] Jul 22, 2018 8:30:00 PM / by Eustis Mortgage posted in home prices, stock market, mortgage credibility, holiday season, single women homebuyers, first-time homebuyers, mortgage credit, millennial homebuyers, dodd-frank act, home financing, overcoming real estate fears, property taxes, mortgage tax deductions, home renovations, real estate scam, flood insurance, pending home sale, natural disasters, mortgage market, rental property, housing affordability, mortgage information, VA loans

Moving is an amazing experience that balances between exciting and stressful. We're here to make the process easier for you not only through the loan process, but the home buying process as a whole. While you're busy making sure paperwork is all together, everyone is happy with the choice and ready to move, some things can be left forgotten in order to move. There are a few necessities that make the process go a lot smoother and we're going to share them with you. We searched far and wide to develop the best checklist a new or veteran homeowner can go by in order to remember everything that is needed to be accomplished before and after the move is completed.