VA loans are highly regarded and considered to the best mortgage product available to service members and veterans. Determining eligibility is a far simpler process than most may think. A conversation with a qualified mortgage professional and review of a few service-related documents can quickly determine whether or not a veteran is eligible. After getting past those few steps, borrowers unlock the many advantages of a VA mortgage including: no down payment, no mortgage insurance, and stronger loan-servicing protections than other mortgages.

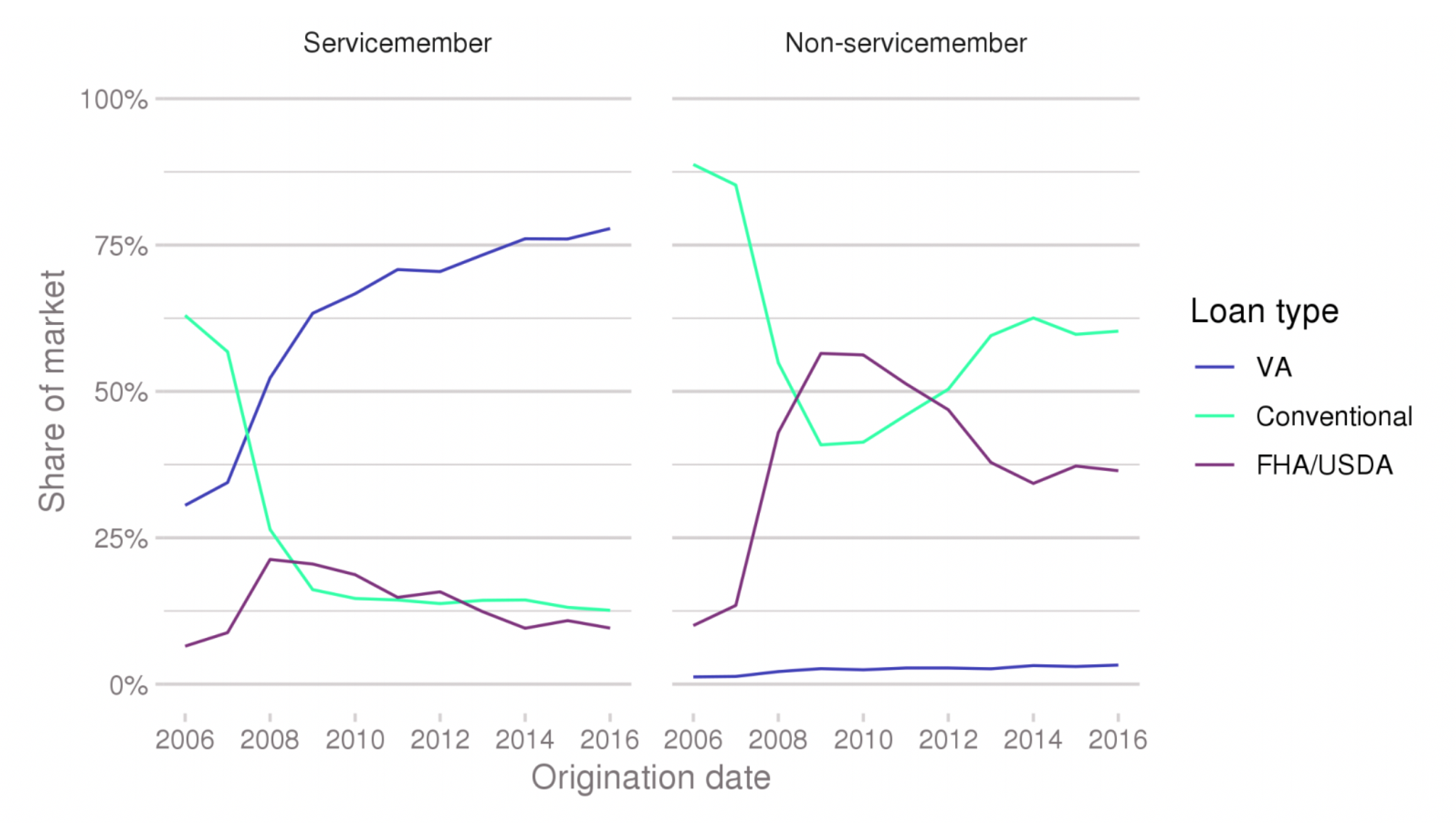

As part of the Bureau’s mission to continue educating and empowering service members to make better informed financial decisions, more information is becoming accessible on the benefits of purchasing a home using a VA-loan. This has caused an enormous increase of first-time homebuyers choosing a VA-loan as their loan of choice. In a short amount of time, the scale completely flipped as the use of VA-loans rose from 30% in 2007 to 78% in 2016. Before this, homes were being financed primarily using conventional and nonconventional mortgages.

Along with the rise of the use of VA Loans, an increase in loan amounts has dramatically spiked. The average dollar amount for a VA loan taken out in 2006 was $156,000, and as of 2016 has risen to $212,000. This is more than the amount of any other loan used by a service member. The average amount for a Conventional and FHA/USDA for service members has ended up being less than $150,000 since 2005.

Read the full CFPB report here.