What Buyers Should Look for When Buying Their First Home

Oct 18, 2021 7:30:00 AM / by Eustis Mortgage posted in fha loan, mortgage news, homeownership, loan payments, first time homeowner, buying vs. renting, investment, mortgage, mortgage refinancing, real estate, real estate market, loans, credit score, 3% down mortgage, home buying, applying for a loan, homebuyers, homeowners insurance, mortgage rates, mortgage terms, co-signing a mortgage, single women homebuyers, housing industry, home value, title insurance, Loan Officer

The Future Of Homes Starts Now

May 3, 2018 8:30:00 PM / by Eustis Mortgage posted in first time home owner, loan candidate, mortgage rate, renting vs. buying, home ownership, homeownership, expenses, first time homeowner, buying vs. renting, realtor tips, selling your home, mortgage process, technology, housing market, credit cards, mortgage pre-approval, private mortgage insurance, mortgage refinancing, 3% down mortgage, applying for a loan, mortgage qualification, advantages of choosing a mortgage lender, pay off your mortgage, buying a vacation home, non-farm payroll, housing options, pmi rates, mortgage scam, today's interest rates, mortgage savings, re-apply for a mortgage, home prices, room-rental services, relationship status, holiday season, obstacles to homeownership, disaster recovery, mortgage credit, home financing, overcoming real estate fears, inflation, home builder confidence, real estate scam, federal reserve, student loan debt, natural disasters, awards, home building, mortgage underwriting, rental property, transitioning into homeownership, home appraisal, housing affordability, mortgage information, title insurance, VA loans, Active Military and Veterans, prepaids

As homes evolve over the years incorporating new technology and innovation into them, current and future home owners have to be sure to keep up on what's coming next. Think smart. Homes are getting faster and more environmentally friendly all over the world and consumers expect them to be in prime locations. People are willing to have a more compact living space in order to be in a prime area featuring restaurants, bars, grocery stores they can walk to instead of using their car.

How the New Tax Reform Affects Deductions for Homeowners and Home Sellers

Mar 2, 2018 5:30:58 PM / by Eustis Mortgage posted in first time home owner, fha loan, loan candidate, standard loans, mortgage rate, economy, mortgage news, renting vs. buying, home ownership, homeownership, tips, loan payments, 203K Streamline, expenses, first time homeowner, buying vs. renting, realtor tips, selling your home, mortgage process, technology, housing market, credit cards, money, rent rates, pmi, trid, first time home buyers, investment, second home, mortgage, mortgage pre-approval, private mortgage insurance, mortgage refinancing, real estate, real estate market, renovation, loans, tax benefits, 3% down mortgage, home buying, applying for a loan, mortgage qualification, first time home sellers, buying a vacation home, pmi rates, mortgage rates

January 1, 2018, President Donald Trump’s new 7 year tax reform law became effective.

Home Prices Aren’t The Only Increasing Housing Costs—Rent Is Steadily Rising As Well

Aug 1, 2017 12:51:40 PM / by Eustis Mortgage posted in mortgage news, buying vs. renting, rent rates

Since the beginning of this year, increasing mortgage rates and rising listing prices have dominated news headlines throughout the country. As a result, many potential homebuyers have gravitated towards signing another rental lease instead of jumping into the housing market and applying for a mortgage—but this may not be the best financial decision. Overall, rent rates are fluctuating as well.

In Which U.S. Cities Should You Buy Rather Than Rent? Here Are The Top 5

May 19, 2017 2:52:03 PM / by Eustis Mortgage posted in mortgage news, buying vs. renting

Throughout the United States, many people believe that renting is significantly cheaper than owning a house. This is actually only true in some select cities—meaning you could be paying more for a temporary lease than you would for reaping the long-term financial benefits of homeownership!

Paying A Mortgage Is Actually Cheaper Than Renting In 42 States

Aug 16, 2016 10:54:55 AM / by Eustis Mortgage posted in mortgage news, buying vs. renting

Many people believe that renting is significantly cheaper than owning a house. This is actually only true for eight states and the District of Columbia—meaning it’s much less expensive to pay a monthly mortgage in 84% of the U.S.!

To Rent Or To Buy: Factors To Consider When Making A Decision

Apr 28, 2016 11:30:35 AM / by Eustis Mortgage posted in mortgage news, buying vs. renting

Life is full of important financial decisions, but perhaps the most important decision that adults are faced with in their lifetime is whether to rent or buy a home. While the decision to move from renting to buying may seem daunting at first, the value of owning property can outweigh any initial costs. Before you make your decision, consider these important factors:

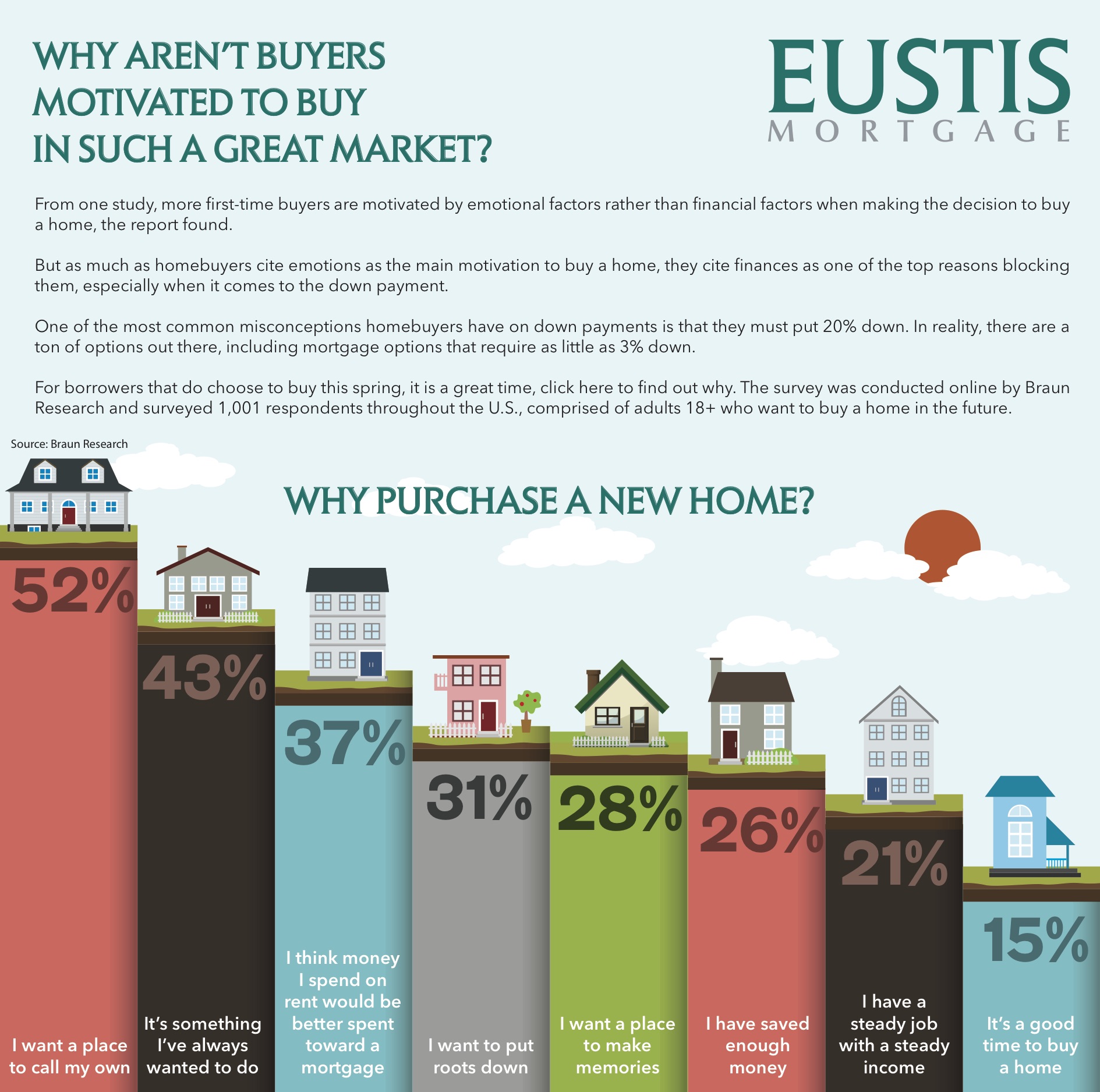

Why Aren't Buyers Motivated to Buy in Such a Great Market?

Apr 13, 2016 1:47:02 PM / by Eustis Mortgage posted in homeownership, first time homeowner, buying vs. renting

More first-time buyers are motivated by emotional factors rather than financial factors when making the decision to buy a home, a report found.

Homeowner Expenses that Renters Don't Know About

Apr 12, 2016 12:03:21 PM / by Eustis Mortgage posted in homeownership, expenses, first time homeowner, buying vs. renting

Homeownership is, for many, the culmination of the American Dream and a major rite of passage. We’ve written many times on this very blog that the fastest path to building financial wealth is — you guessed it — owning a home.