As homes evolve over the years incorporating new technology and innovation into them, current and future home owners have to be sure to keep up on what's coming next. Think smart. Homes are getting faster and more environmentally friendly all over the world and consumers expect them to be in prime locations. People are willing to have a more compact living space in order to be in a prime area featuring restaurants, bars, grocery stores they can walk to instead of using their car.

The Future Of Homes Starts Now

[fa icon="calendar'] May 3, 2018 8:30:00 PM / by Eustis Mortgage posted in first time home owner, loan candidate, mortgage rate, renting vs. buying, home ownership, homeownership, expenses, first time homeowner, buying vs. renting, realtor tips, selling your home, mortgage process, technology, housing market, credit cards, mortgage pre-approval, private mortgage insurance, mortgage refinancing, 3% down mortgage, applying for a loan, mortgage qualification, advantages of choosing a mortgage lender, pay off your mortgage, buying a vacation home, non-farm payroll, housing options, pmi rates, mortgage scam, today's interest rates, mortgage savings, re-apply for a mortgage, home prices, room-rental services, relationship status, holiday season, obstacles to homeownership, disaster recovery, mortgage credit, home financing, overcoming real estate fears, inflation, home builder confidence, real estate scam, federal reserve, student loan debt, natural disasters, awards, home building, mortgage underwriting, rental property, transitioning into homeownership, home appraisal, housing affordability, mortgage information, title insurance, VA loans, Active Military and Veterans, prepaids

Invest In Real Estate While You're Young

[fa icon="calendar'] Mar 23, 2018 12:00:00 PM / by Eustis Mortgage posted in fha loan, economy, homeownership, tips, loan payments, realtor tips, mortgage process, technology, credit cards, money, pmi, trid, investment, mortgage pre-approval, real estate market, loans, applying for a loan, brexit, first time home sellers, beat an all-cash offer, louisiana floods, getting mortgage approved, homebuyers, home inspection, mortgage stress, lender lingo, stock market, community development block grant, mortgage calculator tricks, Announcements, room-rental services, job change, co-signing a mortgage, interest rates, credit card rule, holiday season, single women homebuyers, obstacles to homeownership, housing industry, homebuilder sentiment, mortgage credit availability, mortgage credit, FICO Scores, closing costs, property taxes, mortgage tax deductions, fannie mae, federal reserve, student loan debt, homebuying tricks, mortgage market, fha 203k loans, mortgage underwriting, rental property, mortgage after divorce, transitioning into homeownership, home appraisal, housing affordability, mortgage information, title insurance, VA loans, Active Military and Veterans, prepaids

The first taste of living by your own rules can feel pretty liberating, but can feel burdening if your future plans keep haunting you in your sleep.

How the New Tax Reform Affects Deductions for Homeowners and Home Sellers

[fa icon="calendar'] Mar 2, 2018 5:30:58 PM / by Eustis Mortgage posted in first time home owner, fha loan, loan candidate, standard loans, mortgage rate, economy, mortgage news, renting vs. buying, home ownership, homeownership, tips, loan payments, 203K Streamline, expenses, first time homeowner, buying vs. renting, realtor tips, selling your home, mortgage process, technology, housing market, credit cards, money, rent rates, pmi, trid, first time home buyers, investment, second home, mortgage, mortgage pre-approval, private mortgage insurance, mortgage refinancing, real estate, real estate market, renovation, loans, tax benefits, 3% down mortgage, home buying, applying for a loan, mortgage qualification, first time home sellers, buying a vacation home, pmi rates, mortgage rates

January 1, 2018, President Donald Trump’s new 7 year tax reform law became effective.

Homeownership Still Means Financial Security to Most Homebuyers

[fa icon="calendar'] Jan 5, 2018 12:42:18 PM / by Eustis Mortgage posted in mortgage news, homeownership

How Homeownership May Just Help Your Retirement

[fa icon="calendar'] Nov 18, 2016 2:46:25 PM / by Eustis Mortgage posted in mortgage news, homeownership, retirement

Owning a home is one of the greatest investments you’ll make in your lifetime. Owning that home for a long period of time, however, may just ensure that you get the most out of your prior investment. According to a recent study by Urban Institute, leveraging the equity of your home at an older age can significantly grow your retirement funding, as retirees can then sell their homes for a profit or use their home equity line of credit to increase personal funds. After all, the housing market is one of the nation’s greatest investment arenas, making older American homes highly valuable assets in today’s market.

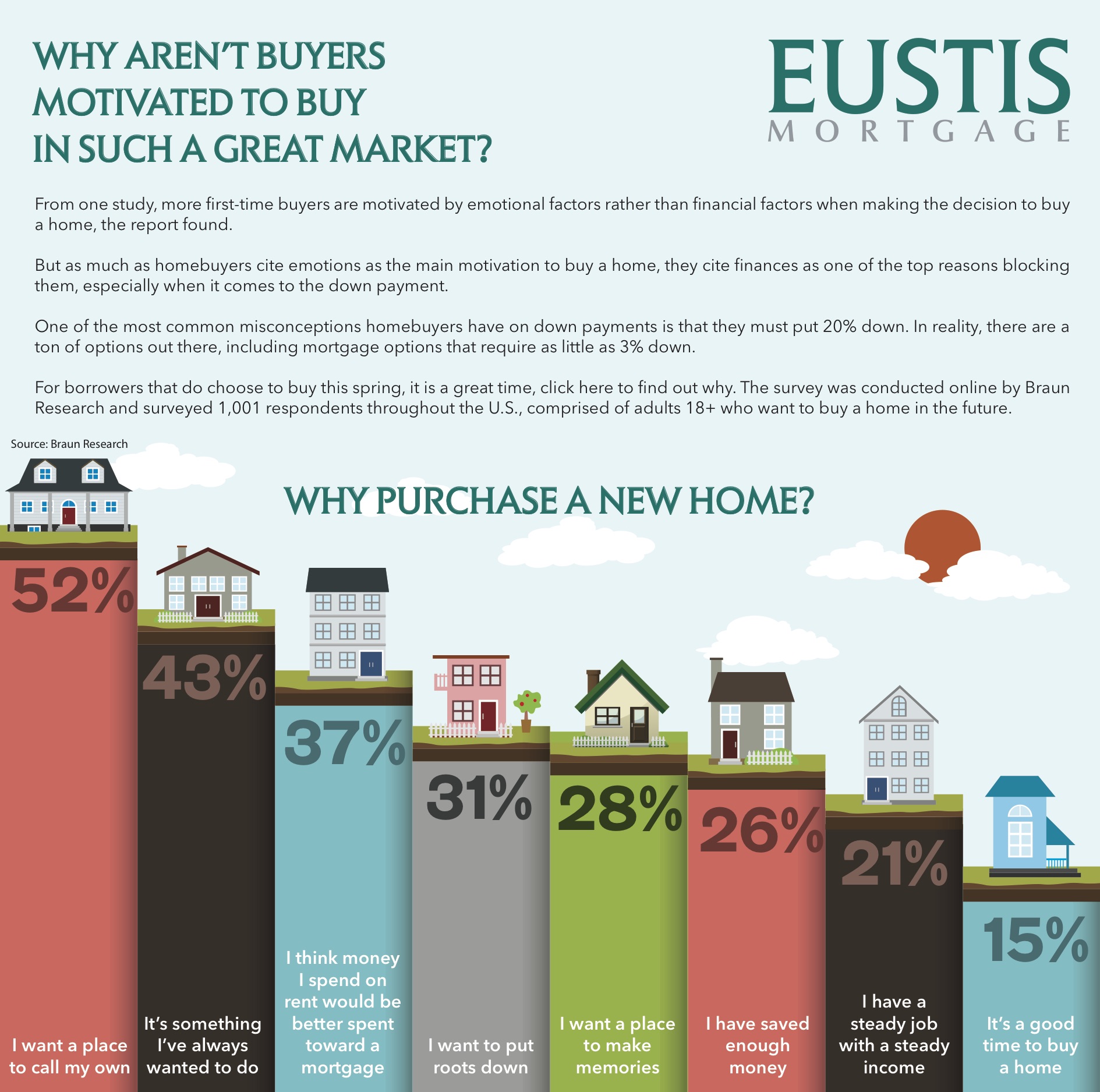

Why Aren't Buyers Motivated to Buy in Such a Great Market?

[fa icon="calendar'] Apr 13, 2016 1:47:02 PM / by Eustis Mortgage posted in homeownership, first time homeowner, buying vs. renting

More first-time buyers are motivated by emotional factors rather than financial factors when making the decision to buy a home, a report found.

203K Streamline and Standard Loans

[fa icon="calendar'] Apr 12, 2016 3:35:49 PM / by Eustis Mortgage posted in standard loans, homeownership, tips, 203K Streamline, loans

The Federal Housing Administration (FHA) 203k loans are immensely popular renovation loan products available to well-qualified borrowers looking to purchase either a fixer-upper or a home that just needs one or two additions to be “perfect”.

Renovation Loan Candidates

[fa icon="calendar'] Apr 12, 2016 3:14:30 PM / by Eustis Mortgage posted in loan candidate, homeownership, tips, renovation

In your house hunting journey, you’ve likely encountered a property that’s perfect in every way — except for that one thing. Maybe it’s a slightly (or really) outdated kitchen, one too few bedrooms, or some minor to moderate termite-induced damage to the sill plate. Here in central Louisiana, wet basements are quite common and a home inspector will likely discover black mold and other allergens as a result.

Understanding Renovation Loan Payments

[fa icon="calendar'] Apr 12, 2016 2:57:45 PM / by Eustis Mortgage posted in homeownership, tips, loan payments, renovation

Payments on your renovation loans really aren’t fundamentally different from a conventional mortgage payment. Each month, a portion of the monies allocated will go to paying down the principal amount borrowed, another portion will go to paying interest over the lifetime of the loan. A portion of the original borrowed amount will be held in escrow to pay the various contractors and vendors who are working on your renovation and construction project.

The Biggest Homebuying Concerns and How To Get Over Them

[fa icon="calendar'] Apr 12, 2016 2:56:04 PM / by Eustis Mortgage posted in homeownership, tips, first time homeowner

Buying a home is a major financial decision. There’s no doubt about it. You have to carefully consider your financial readiness, mitigate any potential loss in value if the housing market takes a turn, prepare for unexpected expenses (houses need care and feeding, too!) and, even after all that planning and preparation, homebuyers wake up in the middle of the night fearful they’ve made the wrong decision.