The U.S. Census Bureau and the Department of Housing and Urban Development recently reported that the number of new homes to break ground in March fell 9 percent from February’s figure. Construction numbers typically fluctuate during the year, but in 2015 the numbers have been exceedingly volatile, Construction activity dropped in January and March, but had a 6.9 percent rise in February.

Eustis Mortgage

Recent Posts

Housing Construction Slowed in March, But Still Up From Last Year

[fa icon="calendar'] Apr 20, 2016 1:15:53 PM / by Eustis Mortgage posted in mortgage news, housing market

Mortgage Credit Available Now More Than Ever

[fa icon="calendar'] Apr 19, 2016 10:54:02 AM / by Eustis Mortgage posted in mortgage news, home buying, applying for a loan

Recently, the credit availability index has reached an all-time low, with mortgage credit becoming increasingly available. The Housing Finance Policy Center found that during the fourth quarter of 2015 it was easier for homebuyers to secure financing than it was during the previous quarter. This low marks a possible light at the end of the tunnel of the housing crash, as credit availability is an important indicator of the conditions of the market. Following the housing crash, lending standards tightened and it became more difficult for prospective buyers to get a loan.

Mortgage Rates Continue to Drop

[fa icon="calendar'] Apr 15, 2016 1:32:34 PM / by Eustis Mortgage posted in mortgage rate, economy, mortgage news, mortgage process

30-year mortgage rates have continued to drop this week, reaching the lowest rates in nearly three years. The recent drop is due in large part to the International Monetary Fund’s (IMF) declaration of concern regarding the global economy, which echo the concerns of the Federal Reserve and the European Central Bank. Many economists believe the rates will continue to drop in the face of uncertainty regarding oil prices and the overall stability of the global economy.

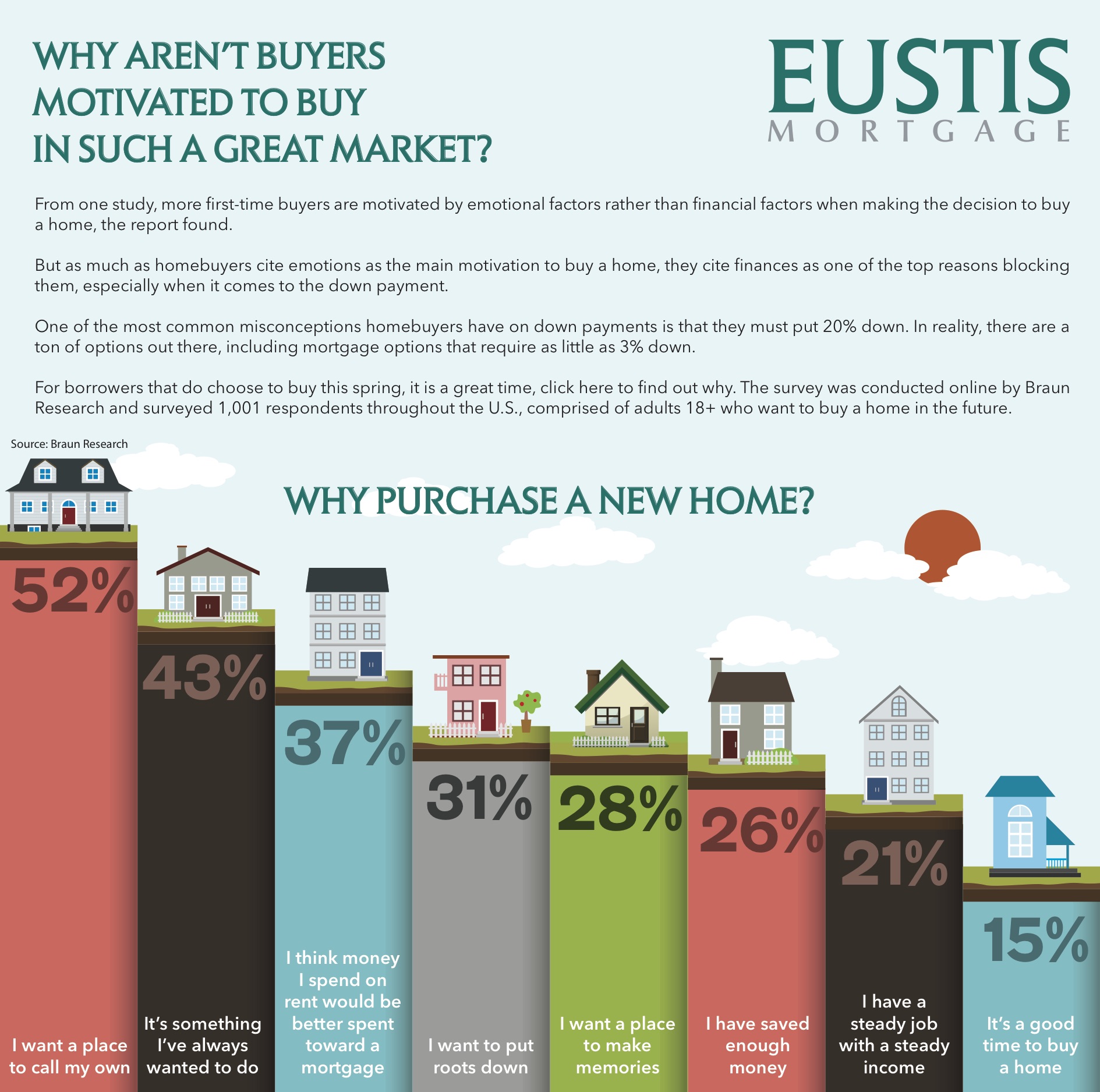

Why Aren't Buyers Motivated to Buy in Such a Great Market?

[fa icon="calendar'] Apr 13, 2016 1:47:02 PM / by Eustis Mortgage posted in homeownership, first time homeowner, buying vs. renting

More first-time buyers are motivated by emotional factors rather than financial factors when making the decision to buy a home, a report found.

203K Streamline and Standard Loans

[fa icon="calendar'] Apr 12, 2016 3:35:49 PM / by Eustis Mortgage posted in standard loans, homeownership, tips, 203K Streamline, loans

The Federal Housing Administration (FHA) 203k loans are immensely popular renovation loan products available to well-qualified borrowers looking to purchase either a fixer-upper or a home that just needs one or two additions to be “perfect”.

Renovation Loan Candidates

[fa icon="calendar'] Apr 12, 2016 3:14:30 PM / by Eustis Mortgage posted in loan candidate, homeownership, tips, renovation

In your house hunting journey, you’ve likely encountered a property that’s perfect in every way — except for that one thing. Maybe it’s a slightly (or really) outdated kitchen, one too few bedrooms, or some minor to moderate termite-induced damage to the sill plate. Here in central Louisiana, wet basements are quite common and a home inspector will likely discover black mold and other allergens as a result.

Understanding Renovation Loan Payments

[fa icon="calendar'] Apr 12, 2016 2:57:45 PM / by Eustis Mortgage posted in homeownership, tips, loan payments, renovation

Payments on your renovation loans really aren’t fundamentally different from a conventional mortgage payment. Each month, a portion of the monies allocated will go to paying down the principal amount borrowed, another portion will go to paying interest over the lifetime of the loan. A portion of the original borrowed amount will be held in escrow to pay the various contractors and vendors who are working on your renovation and construction project.

The Biggest Homebuying Concerns and How To Get Over Them

[fa icon="calendar'] Apr 12, 2016 2:56:04 PM / by Eustis Mortgage posted in homeownership, tips, first time homeowner

Buying a home is a major financial decision. There’s no doubt about it. You have to carefully consider your financial readiness, mitigate any potential loss in value if the housing market takes a turn, prepare for unexpected expenses (houses need care and feeding, too!) and, even after all that planning and preparation, homebuyers wake up in the middle of the night fearful they’ve made the wrong decision.

Why Now Is The Best Time For A Renovation Loan

[fa icon="calendar'] Apr 12, 2016 2:30:58 PM / by Eustis Mortgage posted in homeownership, housing market, real estate market

Do you have a home improvement project that you’ve had in your sights for a while, but something is holding you back — like the perception of a flat real estate market?

Key People in the Mortgage Process

[fa icon="calendar'] Apr 12, 2016 1:18:23 PM / by Eustis Mortgage posted in fha loan, mortgage process, real estate

Applying for, and qualifying for a mortgage, has a lot in common with ballroom dancing. Partners step in and out with you, each taking the lead in their designated time and stepping back out to give the next in line a chance for a few turns around the dancefloor.