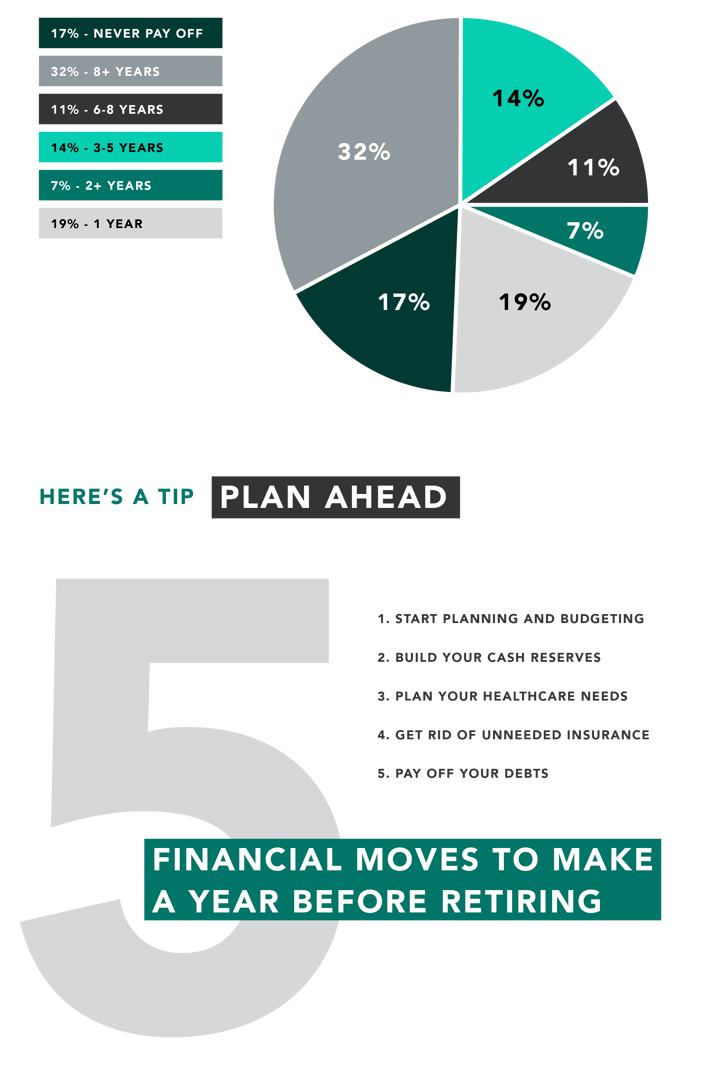

With so many different things to take care of in order to live the American Dream, it seems impossible to pay anything off before or event after retirement.

BIGGEST CAUSES OF DEBT IN AMERICA

44% OF AMERICANS RETIRE WITH A MORTGAGE

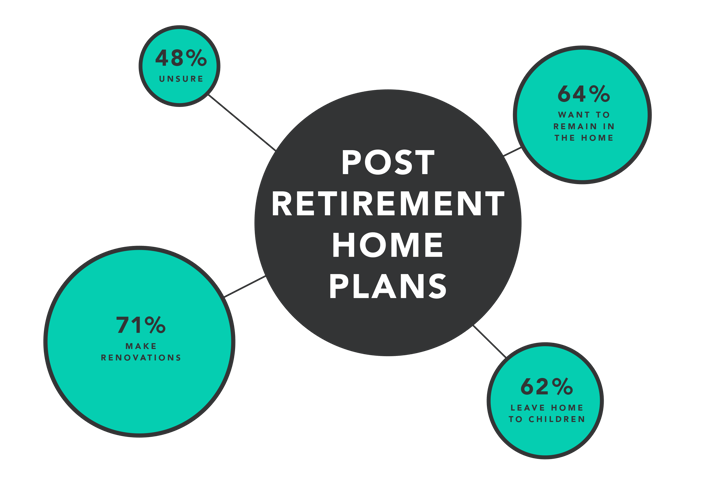

HERE'S WHAT A HANDFUL OF RETIREES PLAN ON DOING WITH THEIR HOME AFTER RETIRING

THE TRICK?

Retirees and pre-retirees can look into

By using the appreciation in your house, you have potential to eliminate Mortgage Insurance, Credit Cards and Student Loans. Or use your home as a source of monthly income by pulling equity to have cash available for daily living.

To learn more on what to do with your mortgage payment as retirement approaches, contact one of our specialists today!