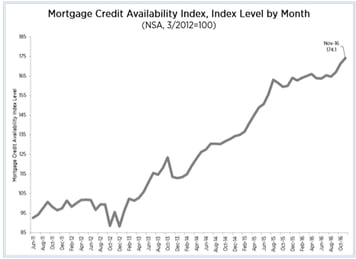

This November, homebuyers’ access to mortgage credit continued on an upward trend. In fact, on Monday, the Mortgage Bankers Association reported that its Mortgage Credit Availability Index (MCAI) increased by 1.6 percent since October.

The MCAI is a measure of the availability of mortgage credit using guidelines from investors who purchase loans through brokers or corresponding channels. Higher values mean a loosening of credit, or more people have access to credit. A decline in this value then means that lending standards are tightening and it is more difficult to access credit.

Lynn Fisher, Vice President of Research and Economics of the Mortgage Banker’s Association, weighed in on the index saying, “Mortgage credit availability increased for the third consecutive month in November, driven by increased availability of conventional low down payments and streamlined refinance loan programs."

There are four components to the MCAI: conforming, government, conventional, and Jumbo, each of which represent different mortgage types. Conforming MCAI saw the biggest change with an increase of 2.2 percent. Government MCAI went up 1.8 percent, Conventional MCAI went up 1.5, while Jumbo MCAI went up just 0.8 percent.

The MCAI index was benchmarked to 100 in March 2012. The conforming and Jumbo have the same base but have increased and decreased respectively. The conforming MCAI now stands at more than double the benchmark, while the jumbo MCAI has fallen below the benchmark. The government and conventional loans have had their bases recalibrated but each one is still exceeding its benchmark.

Overall, mortgage credit availability is steadily growing and 2017 is shaping up to have the most homebuyer mortgages yet. These are great circumstances for people looking to buy or refinance a home. For more information about the housing market, contact a mortgage specialist today.