Since election week in November, increasing mortgage rates have dominated news headlines throughout the country. What most people don’t realize, however, is that home prices and mortgage rates aren’t the only spiking costs in today’s economy—the cost of rent has drastically increased as well.

According to ABODO’s Annual Rent Report, last year held more rent rate increases than decreases, with an average month-to-month change of .67 percent. That’s an increase of $85 between January and December, leaving the average renter paying over $1,001 per month in 2016.

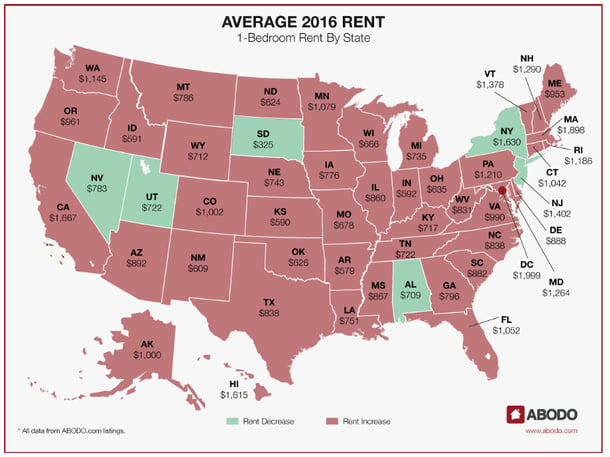

The rent rate hikes are particularly visible in ABODO’s state-by-state map, where all but six states are highlighted for their increase in average rent last year.

Although California and Hawaii show the highest rent rates on the map, Rhode Island reportedly had the largest rent hike last year—rising 7.1 percent in its monthly average. Connecticut showed the second largest increase, with the average cost of one-bedrooms at $1,042 per month. Minnesota, Arizona, Washington D.C., Idaho, Georgia, and Oregon also had substantial increases, with rent rising over 2 percent since January of last year.

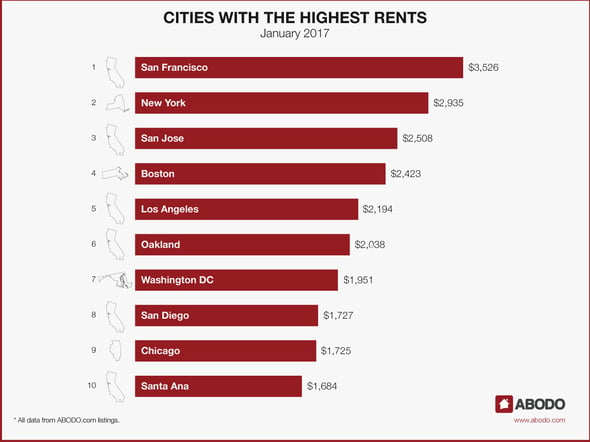

Similar to these drastic shifts in state averages, many city dwellers experienced large hikes in their monthly rent rates. In fact, various cities have more than doubled their state’s rent average, including Columbus, GA (>5%); Raleigh, NC (3.8%); Winston-Salem, NC (3.1%); Scottsdale, AZ (3.7%); and El Paso, TX (2.7%). As a result, the following are today’s cities with the highest rents.

With such high rent rates now dominating today’s housing market, it’s a great time to begin considering alternate home financing options. For more information about the housing industry, or to learn more about home financing, contact one of our mortgage specialists today.